[ad_1]

In transient: TSMC simply had its finest month ever when it comes to gross sales, and it appears like 2022 may additionally be its finest yr but. Strong demand for GPUs, CPUs, consoles, and telephones has been a boon for foundries like TSMC, who’s utilizing it to gasoline capability expansions in Taiwan, Japan and the US.

Taiwan Semiconductor Manufacturing Company (TSMC) launched its preliminary report on its Q1 2022 earnings this week. The world’s largest semiconductor foundry mentioned it recorded gross sales of NT$146.9 billion (round $5.2 billion) in February.

This is the corporate’s highest recorded income determine for the month of February, and whereas it’s down 15 p.c month-on-month when in comparison with January, it represents a 38 p.c improve when in comparison with the identical interval final yr. The distinction from January is generally attributable to downtime associated to the week-long Lunar New Year vacation.

TSMC says it recorded mixed gross sales of NT$319.1 billion for the primary two months of 2022, which is a 36.8 p.c year-over-year improve. The firm expects an uptick in gross sales for this month, so it has adjusted its income forecast to mirror a goal of $16.6 billion to $17.2 billion for the primary quarter.

The firm has loved a powerful monetary efficiency over the previous two years amid unrelenting demand for chips made on its superior course of nodes. Earlier this yr, TSMC promised it could spend wherever from $40 billion to $44 billion on upgrading its manufacturing capability in 2022.

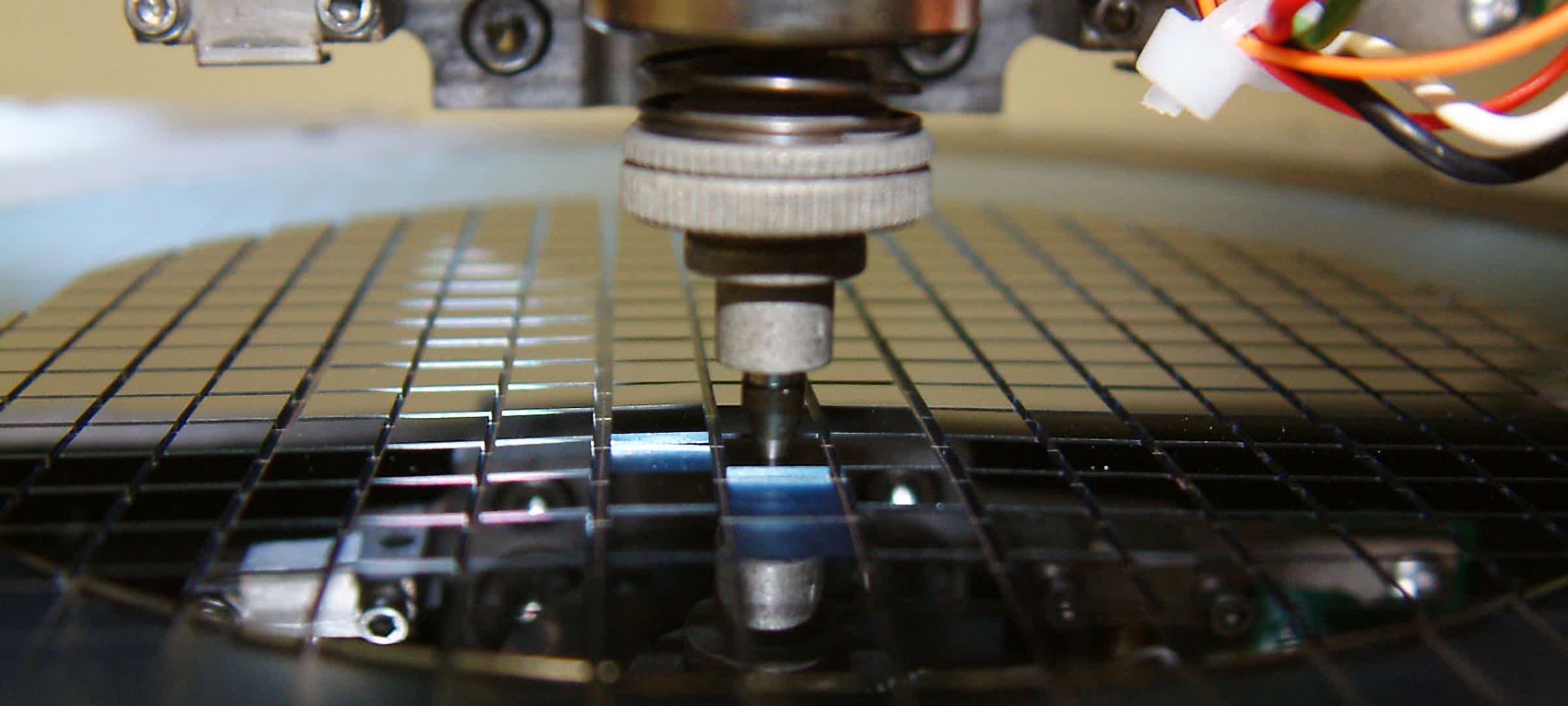

Apple stays TSMC’s largest buyer, with an estimated 26 p.c of its income coming from the Cupertino big. Apple’s just lately introduced M1 Ultra chipset is the results of a deeper collaboration with TSMC, involving the latter’s 4nm course of node in addition to its superior 2.5D chip-on-wafer-on-substrate with silicon interposer (CoWoS-S) know-how.

The foundry has many causes to be optimistic in regards to the future, as Nvidia is alleged to have spent $10 billion for a big chunk of its 5nm capability. Its 3nm course of node additionally appears promising, with Qualcomm planning to faucet into it for future Snapdragon 8-series chips.

This yr, TSMC has determined to extend wafer costs for its 7nm and 5nm course of nodes, and if historical past is any indication Apple will possible benefit from the smallest worth hike. Other corporations will see wherever from 10 to twenty p.c larger costs beginning in Q3 2022.

Fortunately, that is additionally when Nvidia and AMD’s AIB companions anticipate to see a ten p.c improve in graphics card shipments, so it’s doable the wafer worth hike gained’t have a pronounced impact on retail costs for GPUs. Either method, TSMC is optimistic about its outlook and expects its 2022 gross sales to develop by 25 to 29 p.c when in comparison with final yr.

[ad_2]