[ad_1]

What simply occurred? Facebook has seen its variety of each day energetic customers (DAUs) improve in Q1 2022 after experiencing its first-ever decline 1 / 4 earlier, serving to push its shares up 19%. But the AR and VR division (Reality Labs), an necessary a part of its metaverse plans, misplaced $2.96 billion, including to the $10.2 billion loss it recorded all through final 12 months.

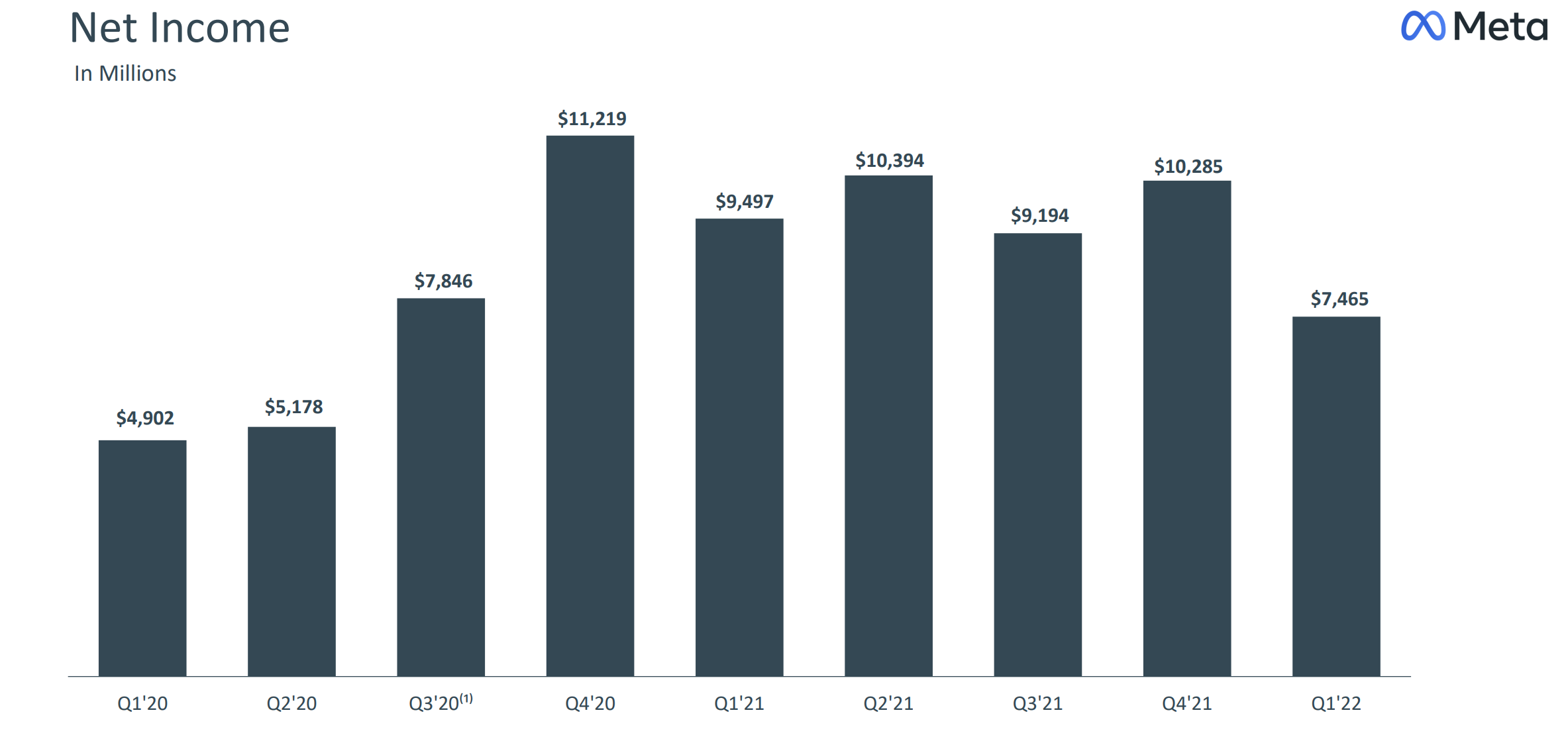

It was a combined bag of first-quarter earnings outcomes for Meta. Facebook DAUs, which had fallen from 1.93 billion to 1.92 billion in This fall 2021, have been as much as 1.96 billion in Q1 2022, beating Wall Street estimates of 1.95 billion. But the corporate’s whole quarterly income of $27.91 billion missed analysts’ estimates of $28.20 billion, a 7% year-over-year development that marks the smallest since Facebook went public a decade in the past and 21% decrease than a 12 months earlier.

Meta’s mixed companies, together with Facebook, Instagram, and WhatsApp, noticed DAUs improve 6% YoY to 2.87 billion, or round 36% of the world’s inhabitants. But internet revenue from its household of apps was down 13% YoY to $11.48 billion.

“More individuals use our companies as we speak than ever earlier than, and I’m pleased with how our merchandise are serving individuals world wide,” mentioned Meta CEO Mark Zuckerberg.

Meta’s imaginative and prescient for the metaverse is an enormous a part of its plans, therefore the identify change final 12 months, however it’s one that may take a variety of money and time. Reality Labs’ $2.96 billion loss is over one billion {dollars} greater than the $1.83 billion it misplaced a 12 months in the past. Zuckerberg insisted, nevertheless, that the mission would repay by the top of the last decade. “Primarily that is laying the groundwork for what I might anticipate to be a really thrilling 2030,” he mentioned, although not all Meta staff are as enthusiastic concerning the metaverse as their chief.

The subsequent quarter is not anticipated to be a very good one for Meta. Russia’s invasion of Ukraine and rising inflation are anticipated to end in month-to-month energetic consumer numbers being flat or declining, whereas income is predicted to be between $28 billion and $30 billion, decrease than analysts’ estimates of $30.6 billion.

[ad_2]