large image: Both international IT spending and shopper demand for electronics have been hit arduous in current months, prompting many firms to revise their income forecasts. Samsung isn’t any exception, however the firm has been reluctant to chop manufacturing to keep up its dominance within the reminiscence market. However, with reminiscence costs hitting report lows and earnings dwindling, the world’s largest maker of DRAM and NAND chips has no alternative however to quickly cut back manufacturing.

Last yr, Samsung obtained its first style of an financial downturn, with oversupply of DRAM and NAND in South Korea. As demand for its chips continues to hunch, the corporate is scrambling to beat TSMC within the race to develop essentially the most superior course of node, hoping to draw prospects from the Taiwanese rival.

Fast ahead to final month, and the issue solely obtained worse after the vacation quarter was the worst since 2008. In truth, the complete DRAM market fell to 2008 lows, prompting firms like Micron and SK Hynix to shrink revenue margins, minimize new investments and lay off staff.

Samsung even took a 20 trillion gained mortgage from its show subsidiary to attempt to pay for its chip-making division by means of manufacturing unit growth in South Korea and the United States. The concept might have sprung from optimism a couple of rebound in shopper demand for PCs and smartphones later this yr, however trade watchers do not assume that may occur till subsequent yr on the earliest. Even enterprise IT spending is slowing as firms giant and small search for different methods to chop prices.

As a outcome, the South Korean tech big will reduce chip manufacturing to what it calls “significant ranges” to stop reminiscence costs from falling additional.

The firm’s newest earnings steering confirmed it posted gross sales of simply 63 trillion gained ($48 billion) within the three months to March, down 19% from the earlier quarter. What’s extra, working revenue is anticipated to drop by greater than 95%, to simply 600 billion gained ($456 million).

A Samsung spokesman advised The Korea Herald that the transfer to scale back chip manufacturing is barely a short-term answer aimed toward stabilizing costs and stemming extra stock. The firm nonetheless expects reminiscence orders to develop over time, so it can proceed to speculate closely in modernizing its manufacturing strains and creating extra superior reminiscence chips. It even enlisted AMD’s assist to fabricate sooner, extra power-efficient DDR5 primarily based on a 12nm course of.

For shoppers, which means that DRAM and SSD costs haven’t bottomed out but. DRAM, specifically, may very well be 15% cheaper this summer season, in accordance with analysts at DevelopmentForce, which implies DDR5 kits might be extra available to these seeking to give their PCs a serious improve.

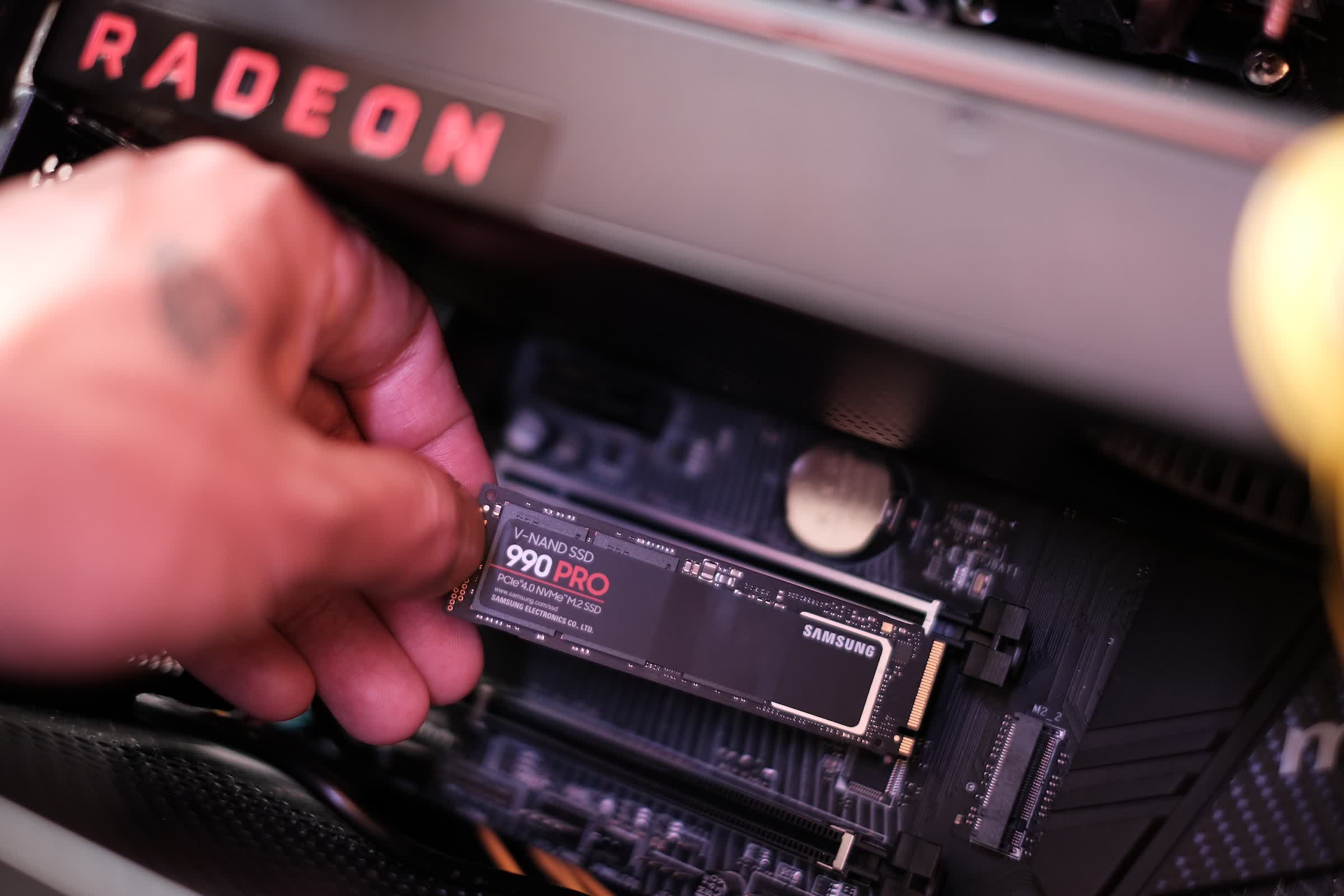

The common promoting value of M.2 SSDs has additionally declined steadily over the previous few months, a pattern that seems to proceed into the second half of the yr. Beware of counterfeit Samsung SSDs, as these are additionally widespread when trying to find offers on-line.

Masthead supply: Babak Habibi