Why it issues: After a dismal fourth quarter of 2022, Samsung’s reminiscence chip enterprise is off to a rocky begin to the yr. The division posted an working revenue loss for the primary time in 15 years. Most poignantly, it was Samsung’s most worthwhile division till late final yr.

Samsung’s reminiscence chip unit misplaced $2.3 billion within the first two months of 2023. Insiders informed information outlet Korea JoongAng Ilbo that the loss for the total quarter might be even larger. An inner report estimated that the corporate may lose as a lot as $3.04 billion within the first quarter of 2023.

“Internally, there was a report that anticipated an working lack of as much as 4 trillion received within the reminiscence chip enterprise within the first quarter,” one of many sources stated.

This decline is notable contemplating that Samsung’s reminiscence chip foundry has not reported a loss for the reason that fourth quarter of 2008. Worse, the remainder of its semiconductor division is popping a revenue and will not be capable to offset the losses. Overall, Samsung expects its machine options (DS) enterprise, which incorporates all of its silicon enterprise, to submit a lack of a minimum of 2 trillion received ($1.52 billion) within the first quarter of 2023.

This was a tough tablet for the corporate to swallow, because the DS division was Samsung’s most worthwhile till late final yr. It dwarfs all different divisions, bringing in $21.6 billion of the corporate’s $33.1 billion whole working revenue in 2022. That’s regardless of the phase’s poor efficiency within the fourth quarter, plunging 97% from 2021 to 270 billion received ($205 million). The decline was largely attributable to plunging NAND and DRAM costs.

As of March 2, 2023, the contract value for 8GB of DDR4 DRAM dropped to $1.83, 75% decrease than 4 years in the past. TrendForce predicts that DRAM costs will drop by about 20% within the first quarter of 2023 and one other 11% within the second quarter. That’s a pointy drop contemplating DRAM is down 34% within the second half of 2022. Likewise, analysts count on NAND costs to proceed falling, down 10% within the first quarter and three% within the second quarter.

Things bought so unhealthy that Samsung’s DS division borrowed 20 trillion received from Samsung Display to pay for semiconductor investments.

KB Securities analyst Jeff Kim informed Korea’s JoongAng Ilbo: “Considering that its money cow, the DS division, is predicted to submit a loss for the primary time in 15 years and abroad subsidiaries maintain many of the firm’s money reserves, the transfer is inevitable.”

The excellent news is that the corporate will proceed to be worthwhile because of its large market share in smartphones and residential home equipment, the place margins will proceed to be wholesome. Kim stated Samsung won’t cut back capital spending this yr and mustn’t resort to “synthetic” cuts in semiconductor manufacturing.

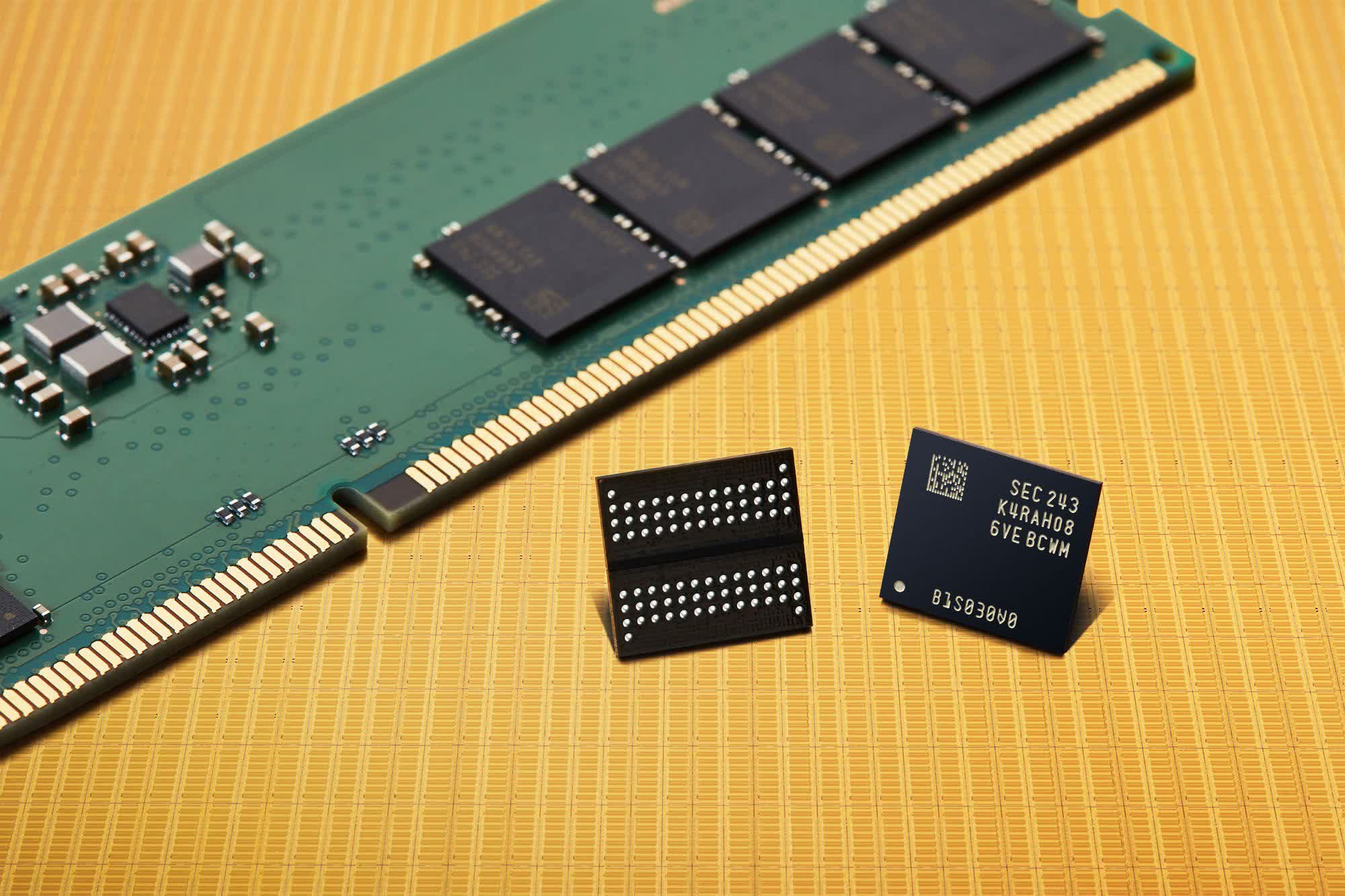

Image supply: Business Wire