[ad_1]

In temporary: Another business analyst agency has reported a big fall in international PC shipments following two years of pandemic-induced progress. The 71.3 million models shipped within the second quarter symbolize a 15.3% year-on-year decline and the second straight quarter of falling shipments.

While a slowdown in PC shipments was at all times anticipated—the results of China’s covid lockdowns and weak demand as shoppers tighten their purse strings over fears of a recession—the double-digit decline was worse than anticipated.

“Fears over a recession proceed to mount and weaken demand throughout segments,” mentioned Jitesh Ubrani, analysis supervisor for IDC’s Mobile Device trackers. Macroeconomic international traits akin to rising inflation and gasoline costs additionally impacted the market.

“Consumer demand for PCs has weakened within the close to time period and is vulnerable to perishing in the long run as shoppers turn into extra cautious about their spending and as soon as once more develop accustomed to computing throughout machine sorts akin to telephones and tablets,” Ubrani defined.

While that may all sound very miserable, it is vital to recollect the pandemic’s affect. Demand for digital objects, video video games, streaming providers, and many others., skyrocketed whereas many of the world labored, discovered, and performed at house, and we’re now seeing the market return to regular. Compared to the pre-Covid years of 2018 (62.1 million) and 2019 (65.1 million), Q2 2022 shipments have been up by fairly a margin.

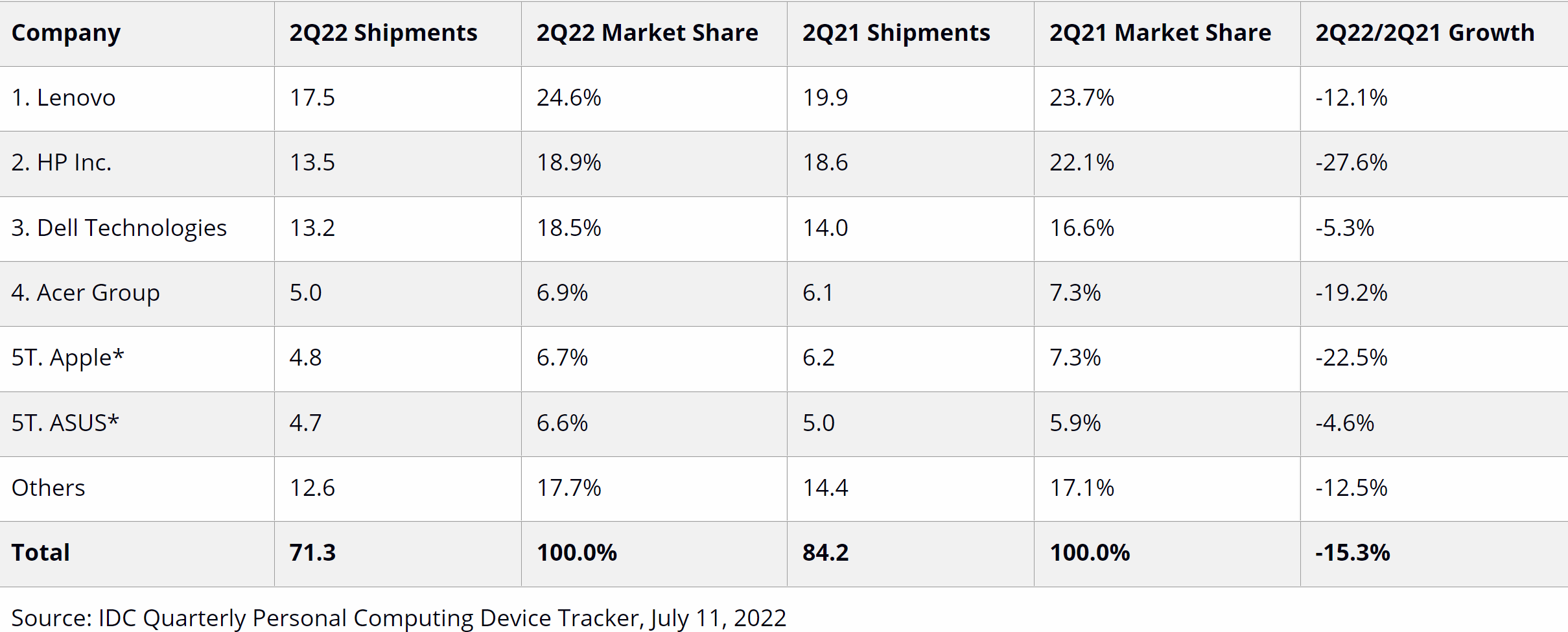

Looking at particular person OEMs, Lenovo managed to carry the highest spot with a 24.6% share (17.5 million models). It was adopted by HP (13.5 million) and Dell (13.2 million). Acer was fourth, and Apple slipped one place to fifth, tying with Asus. Every firm on the listing noticed a yearly cargo decline, with HP (-27.6%) and Apple (-22.5%) hit hardest.

“With training PC urge for food saturating and client demand stagnating, the U.S. PC market is looking at one other quarter of double-digit decline throughout most segments,” mentioned Neha Mahajan, analysis supervisor with IDC’s Devices and Displays group. “Commercial PC demand can also be exhibiting indicators of a slowdown, nonetheless there are nonetheless pockets of progress anticipated in sure business sub-segments the place demand for low-mid vary Windows units stays lively and unfilled.”

IDC’s report backs up Gartner’s Q2 figures, which had PC shipments falling 9.5% YoY. It’ll be attention-grabbing to see if the arrival of latest {hardware} later this 12 months from AMD, Nvidia, and Intel boosts the market. However, a current report suggests we might be ready as late as December for the RTX 4000-series graphics playing cards, and folks may not rush out to purchase one.

[ad_2]