Editor’s observe: The business has modified rather a lot within the eight years since we first analyzed the highest 5 chip corporations. We do not count on semiconductors to be a development business anymore, and the one approach for corporations to continue to grow is to achieve market share (arduous) or purchase different corporations. This is particularly true in semiconductors, as most of those corporations outsource manufacturing to foundries like TSMC and GlobalFoundries.

Nearly a decade later, most mergers have occurred, with few obvious offers to shut. So chances are you’ll assume that our checklist ought to mainly stay unchanged, however it isn’t the case, however the cause for the change is completely different from the previous.

Editor’s observe:

Guest creator Jonathan Goldberg is the founding father of D2D Advisory, a multi-purpose consulting agency. Jonathan develops development methods and alliances for corporations within the cellular, internet, gaming, and software program industries.

Ben Bajarin wrote an identical article some time again in regards to the 5 “most necessary” semiconductor corporations. This resonated as a result of we have written comparable analyzes prior to now. Bajarin has a strong checklist, and we expect it is sensible and necessary that he embody Apple. However, we have now a special opinion.

Bajarin’s standards for itemizing differed from ours. He seems to be at corporations that drive or management computing platforms. By distinction, our checklist is predicated on which corporations will survive the continuing business consolidation, which isn’t the identical factor. We due to this fact don’t embody Apple or Google, as they aren’t topic to the identical business circumstances, however do deserve an honorable point out.

Here’s our checklist:

- The Analog Duopoly of Texas Instruments and ADI

- Qualcomm

- Nvidia

- A Chinese chip firm – to be decided

- The Smoldering Ruins of Intel

Texas Instruments and ADI make this checklist simply however are sometimes ignored. Both corporations make tons of merchandise that the majority of us by no means even take into consideration. With ADI’s acquisition of Maxim, there’s now no different analog firm of comparable dimension. There are many smaller corporations which have carved out particular niches that might maintain years of unbiased worthwhile development, or find yourself being the goal of both. Either approach, there does not appear to be something on the horizon to switch each.

For some time, there have been severe considerations that Qualcomm may not be round for that lengthy. But they’ve now survived a hostile takeover and launched into a sensible new technique that might imply they will be a serious participant for a few years to come back. We ought to in all probability add MediaTek to this checklist as effectively, they appear to be in a strong place, however we have expanded the checklist guidelines for 2 analog corporations, and MediaTek operates in a really completely different set of corporations and geopolitical circumstances.

Nvidia was the third on our final checklist, and if something that appears to have solely broadened their relevance. This builds not solely on their dominant place within the AI market, but additionally on their bold plans to broaden their attain throughout the information heart.

Before we flesh out the remainder of the checklist, a fast rundown of two corporations not on the checklist. The first is Marvel. We assume extremely of Marvell, they have been executing a strong technique for years, however now there is a very apparent query, what do they wish to do subsequent? We’ve seen the controversy over whether or not they could possibly be predator or prey within the semifinal merger. Are they persevering with the acquisition path or are they going to be bought in a bundle? Neither choice is nice, there aren’t many good targets, and there aren’t many motivated acquirers. If we needed to guess, our sense is that they’ve carried out an important job and now wish to give up, and the alternate options would require a variety of effort.

Another firm lacking from the checklist is Broadcom. They had been concerned final time, however now we have now to query how lengthy they wish to keep within the semi enterprise. As we stated, they’re primarily extra of a personal fairness fund that was once semiconductor-focused however is now software-focused than a semiconductor firm. We would not be stunned if sooner or later they begin divesting chip belongings. There are many extra targets within the software program…

On the checklist is a “to be decided” Chinese chip firm. I don’t know which one it’s, possibly it hasn’t been established but, however ten years later there will certainly be a Chinese chip firm with a world scale and excessive competitiveness, and everybody has to concentrate to it. Of course, geopolitics might get in the best way of this imaginative and prescient, however with out additional dramatic escalation, we expect not less than one of many 1000’s of fabless corporations in China at the moment will seemingly survive to change into a world-class participant.

Which brings us to Intel. We more and more consider that Intel can’t survive in its present type. We’re not completely happy about it, however our emotions do not take note of the chilly actuality of enterprise. Of course, there’s nonetheless super worth in what Intel has, and so they have a lot expertise that they’ve some key belongings that can survive. Whether the present firm makes a miraculous comeback, or is extra prone to be spun off and purchased by one other firm, the asset will in the end create worth for somebody.

honor award

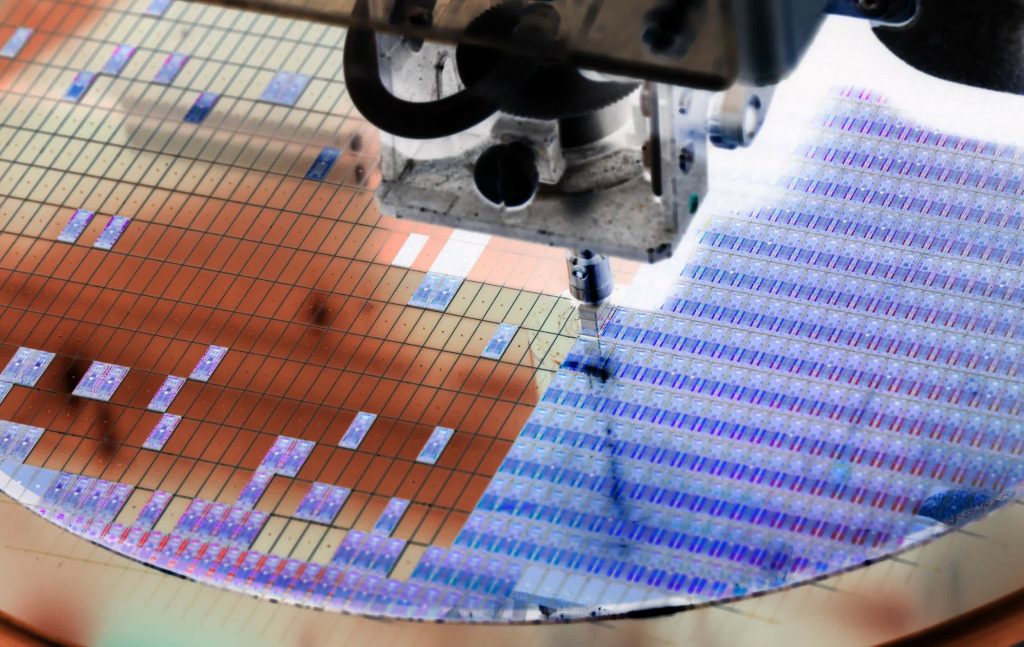

The focus of this checklist is relatively slim – fabless chip design corporations. The wider ecosystem has been effectively lined elsewhere. The world is now realizing how irreplaceable TSMC and ASML have change into, so we’re not trying on the wafer fabrication gear (WFE) area, which does not look prone to change anytime quickly.

Again, we did not contact the reminiscence area, as it has been pretty secure over the previous decade. That could also be altering now, with Samsung seemingly breaking a long-standing truce within the business to take care of its capability growth whereas friends slash capital spending, whereas Western Digital struggles to digest its Sandisk acquisition. Coupled with the sudden layoffs by Chinese reminiscence corporations (YMTC particularly), we might even see some adjustments in reminiscence quickly, however we’ll preserve that out of our dialogue at the moment.

Finally, we have to discuss all of the non-chip corporations designing their very own chips.

Apple stays the best-run semiconductor firm on the planet, regardless of latest indicators of stumbles. Similarly, Google eliminated essentially the most modern semiconductor firm on the planet, an organization whose efforts to broaden its workforce of semiconductor designers might revolutionize the business someplace sooner or later. Finally, Amazon’s AWS, one other contender on this checklist, has carried out greater than anybody else to carry Arm CPUs to the information heart, with the clout altering platform dynamics throughout the business.