[ad_1]

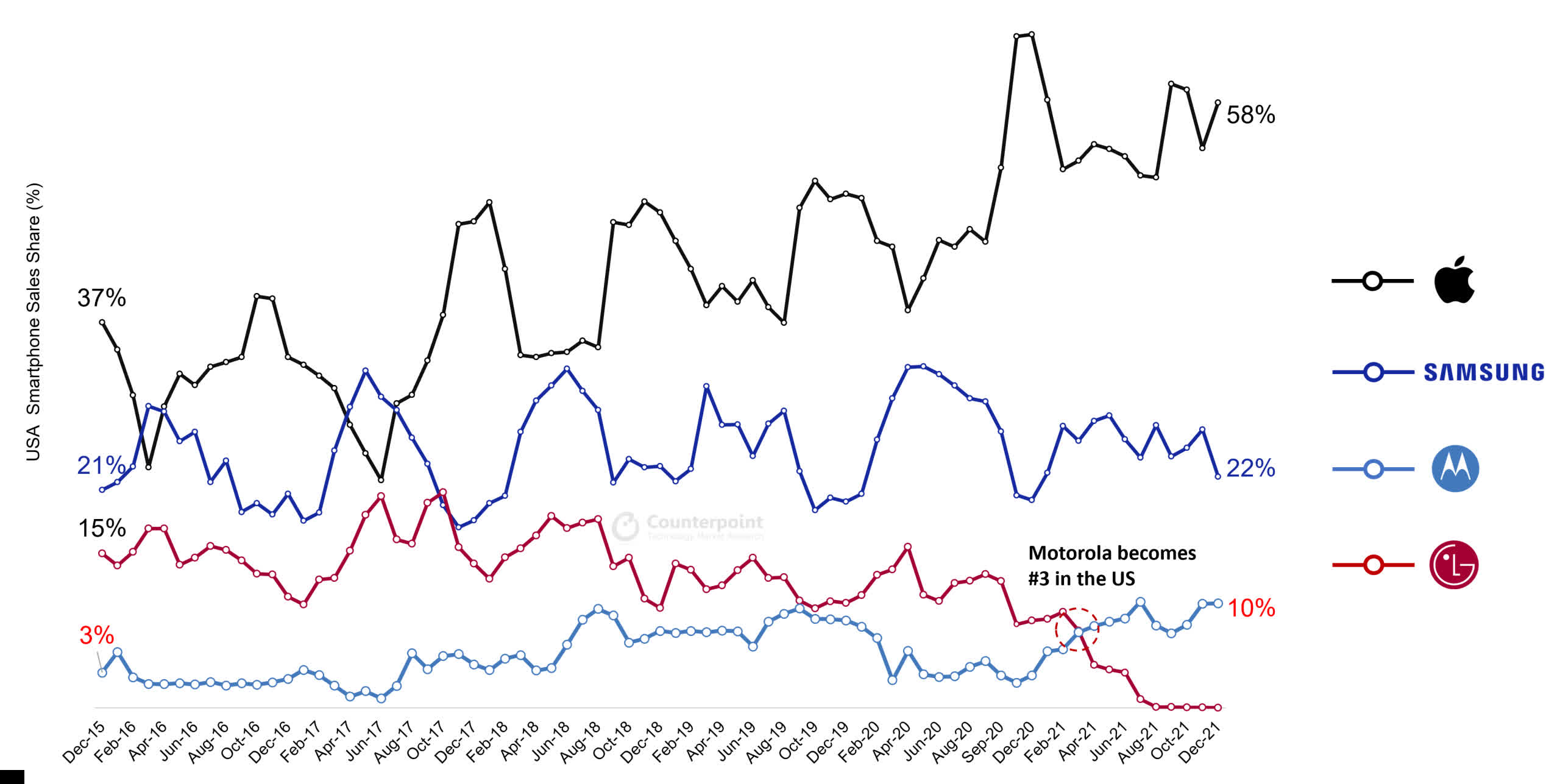

In temporary: One firm’s loss is one other’s achieve. It appears that is very true within the US cellular trade, the place Motorola has taken benefit of LG’s demise to develop into the third-largest smartphone maker within the nation, taking a ten% market share.

According to Counterpoint Research’s Market Pulse Service, Lenovo-owned Motorola was the quantity three smartphone agency within the US final yr. In 2008, again when function telephones had been the dominant variant, Motorola was the biggest handset (smartphones and have telephones mixed) OEM within the US, however 2021 marked the primary time it has entered the top-three US smartphone market.

One of the principle causes behind Motorola’s gross sales rising 131% final yr was the long-predicted exit of LG from the telephone enterprise. The final handset rolled off the Korean agency’s manufacturing line in June, and we began seeing OnePlus, Nokia, and Motorola filling the void LG left behind.

Research Director Jeff Fieldhack stated Motorola has all the important thing traits main carriers need, together with “a full portfolio, skill to ramp volumes, and low return charges.”

Illustrating simply how fashionable its mid- to low-range telephones are, Motorola was the quantity two smartphone firm within the $400 and decrease phase within the United States.

“Motorola’s sub-$300 portfolio – Moto G Stylus, Moto G Power and Moto G Pure – has pushed its success within the US,” Fieldhack added. “Thanks to its reliability, Motorola has been a key free ‘swap’ machine, a tool carriers use to maneuver subscribers from networks which can be being shut off or as a tool MVNOs (cellular digital community operators) use when altering community companions.”

Motorola continued its US success within the first quarter of this yr; Samsung, which has a 22% market share, might quickly begin feeling its competitor respiration down its neck. Apple stays the dominant power within the US market by holding a large 58% share on the finish final yr. But that quantity may not be as excessive in 2022 if studies of Cupertino slashing iPhone SE manufacturing within the face of low demand are correct.

Masthead picture credit score: Jonas Leupe

[ad_2]