[ad_1]

Perhaps you have heard the phrase “money is king” used within the context of cash. Before the digital age, just about all bizarre transactions concerned the trade of money for items or providers rendered. Things are actually completely different in 2022 with Internet banking, cell funds and cryptocurrency, however are we actually prepared to finish our relationship with chilly, laborious money?

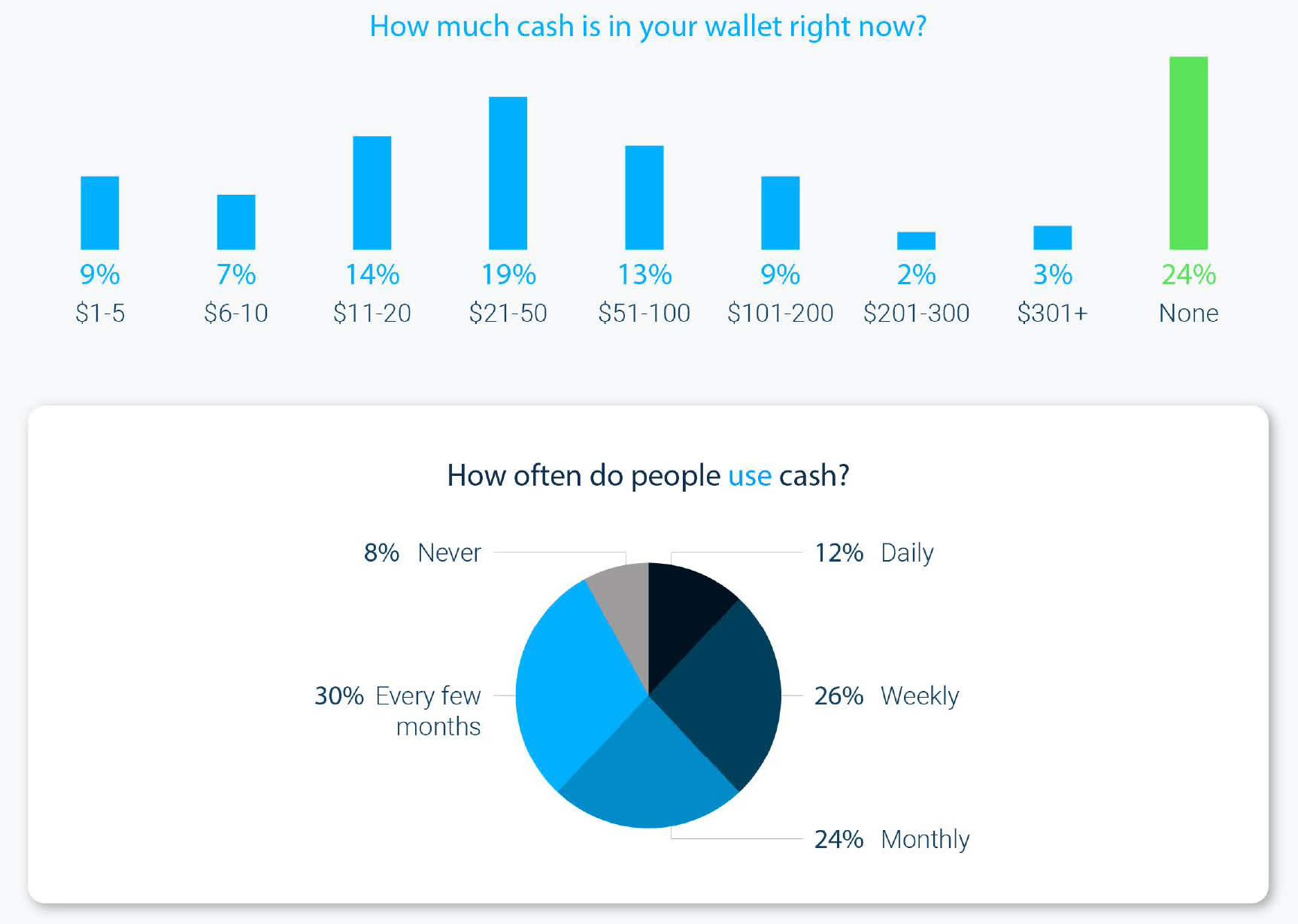

A latest survey from danger administration agency ThirdPartyTrust discovered that 76 % of Americans had money of their pockets or purse on the time they had been polled. When requested how usually they use money, solely 12 % stated they achieve this each day. Just over one in 4 individuals stated they use money on a weekly foundation, and roughly the identical quantity stated they achieve this month-to-month.

Eight % of these polled stated they by no means use money.

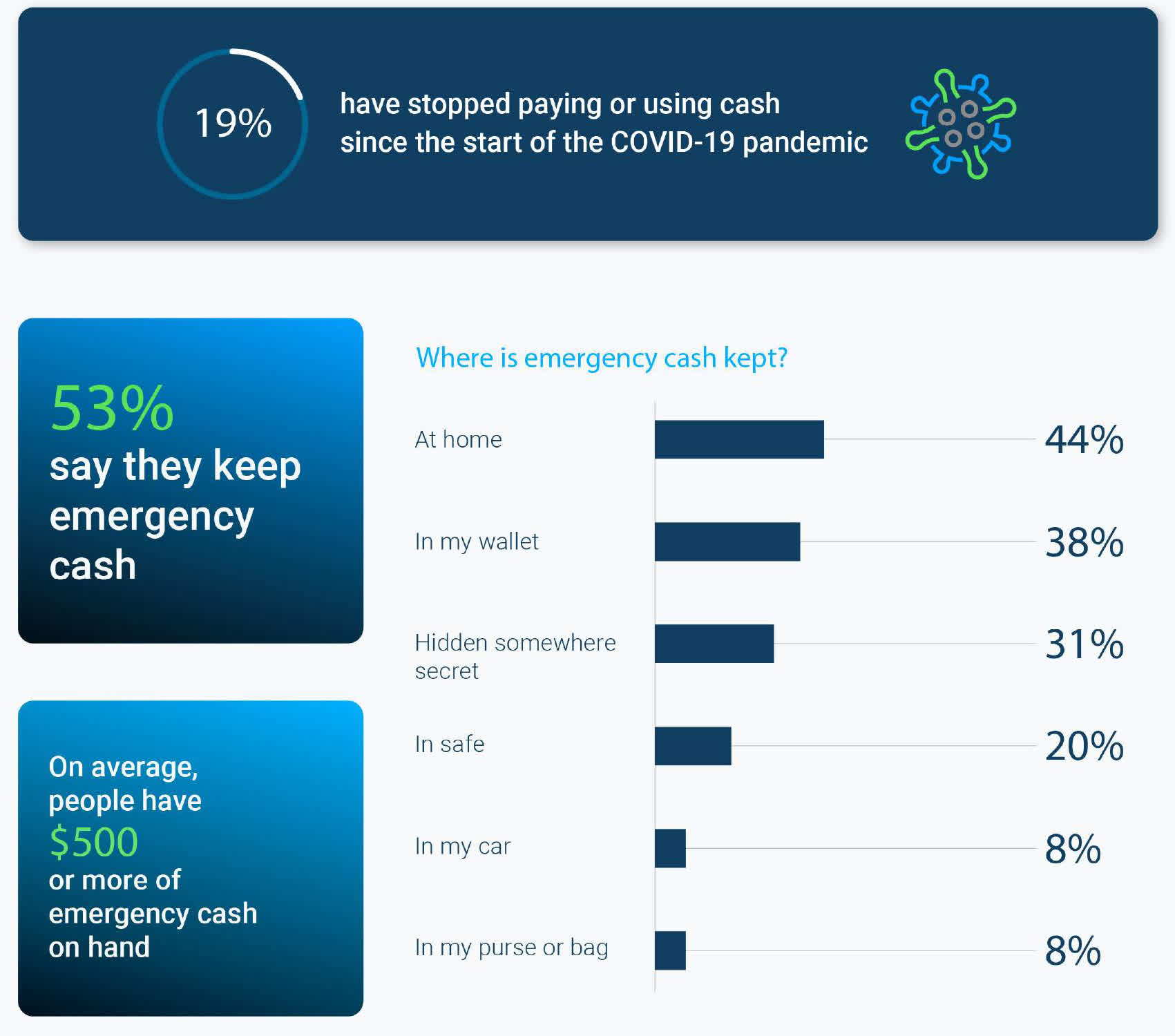

Sanitation could also be an enormous a part of why some shrink back from bodily foreign money. The survey revealed that 41 % of individuals choose money’s look earlier than touching it, and 36 % stated they reject soiled or gross payments. A full 61 % stated they wash their arms or use hand sanitizer after dealing with money or cash, and 19 % admitted they’ve stopped utilizing money for the reason that pandemic began.

Nine out of 10 individuals surveyed stated they use a cell cost service app, with PayPal, Venmo, Zelle and Apple Pay being among the many hottest.

Cash nonetheless has its advantages and for a lot of, it’s as a wet day fund. More than half (53 %) stated they maintain emergency money available (often someplace at residence), and the common mount stashed away is $500.

What does your relationship with money appear like nowadays? Does ease of use, cleanliness or comfort issue into your choice? What about leaving a paper path?

[ad_2]