[ad_1]

Why it issues: Graphics card shipments normally take a small dive within the first quarter, and it is no totally different this time. The provide aspect has improved considerably previously a number of months, whereas demand has solely decreased each month. We may see costs dip under MSRP expectantly later this yr.

By now, it is no secret the times of highly-profitable GPU mining are behind us. A mix of surging vitality costs and a pointy drop in Ethereum’s worth has put a damper on many individuals’s goals of “printing cash” with little effort utilizing shopper {hardware} that they’ll all the time resell to players on the second-hand market. At the identical time, players are reluctant to pay even manufacturer-suggested costs for graphics playing cards when a brand new era is true across the nook.

Jon Peddie Research (JPR) experiences that the GPU market exhibits indicators of slowing down after a couple of years of unrelenting demand. The first quarter of 2022 noticed GPU makers promote 96 million models, which is a 6.2 % lower from the earlier quarter. Analysts imagine this dip outcomes from lockdowns in China, the Russia/Ukraine battle, and rising delays within the international freight transportation system. However, JPR nonetheless predicts a good annual development price of 6.3 % by 2026 for the trade and a market penetration price of 46 % for discrete GPUs by the tip of the forecast interval.

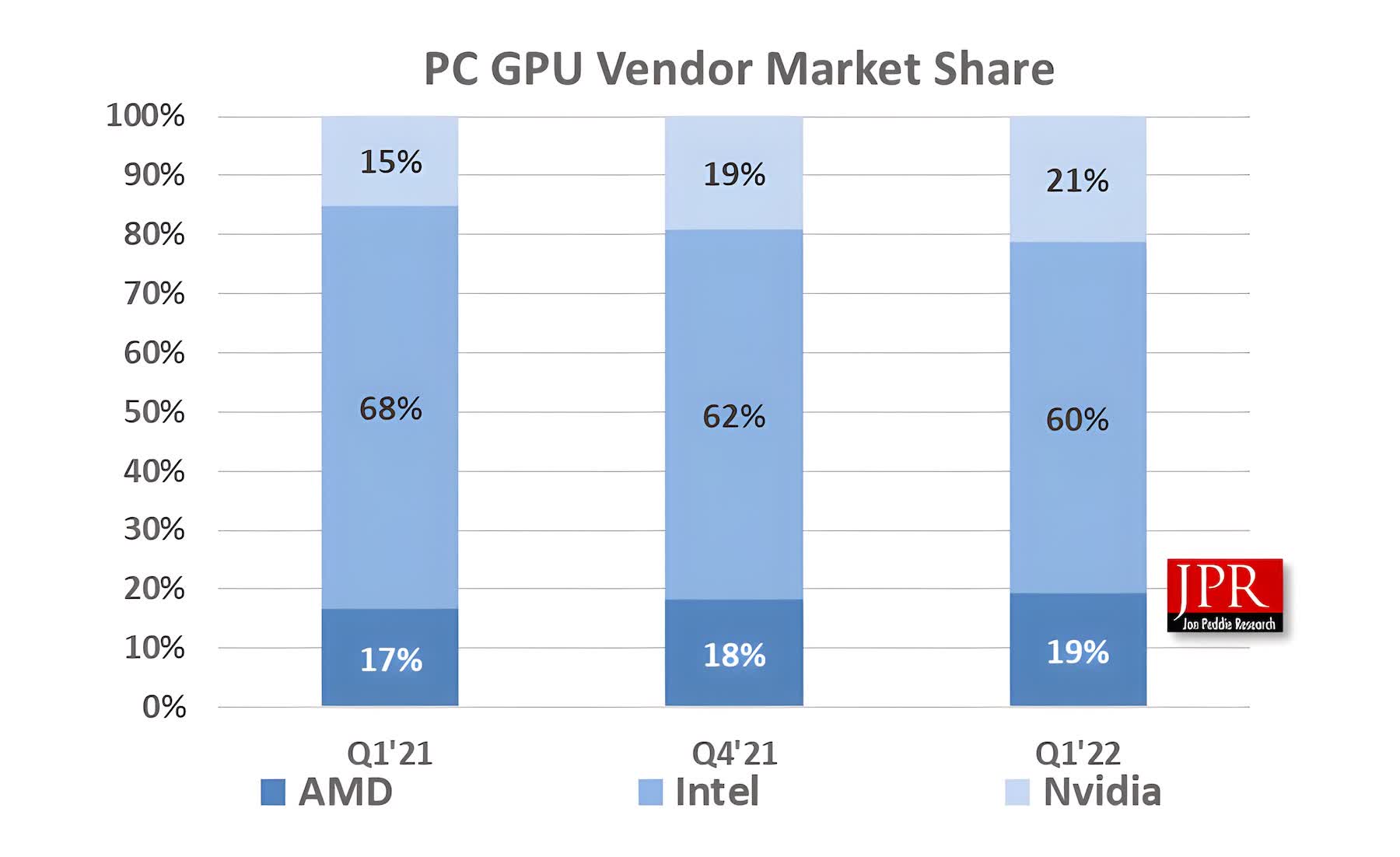

Intel noticed essentially the most important decline, dropping 8.7 % for the three months ending in March, whereas AMD shipments decreased by 1.5 %. In distinction, Nvidia noticed a rise of three.2 %. Furthermore, demand for discrete GPUs made by AIB companions elevated by 1.4 % over the identical interval, excellent news for players.

The general devoted GPU market panorama has remained the identical, with Nvidia holding a market share of 78 % whereas AMD sits at a way more modest 17 %. Intel has a bit of over 4 %, which will not change till it begins delivery its Arc A-series GPUs globally.

The analysts additionally observe that CPU shipments noticed a ten.8 % drop in Q1 2022 in comparison with the earlier quarter and a 26.2 % drop in comparison with the identical quarter of final yr. This unfavorable development suggests that customers’ urge for food for CPU upgrades is waning, so retailers could quickly provide reductions to make them extra enticing.

[ad_2]