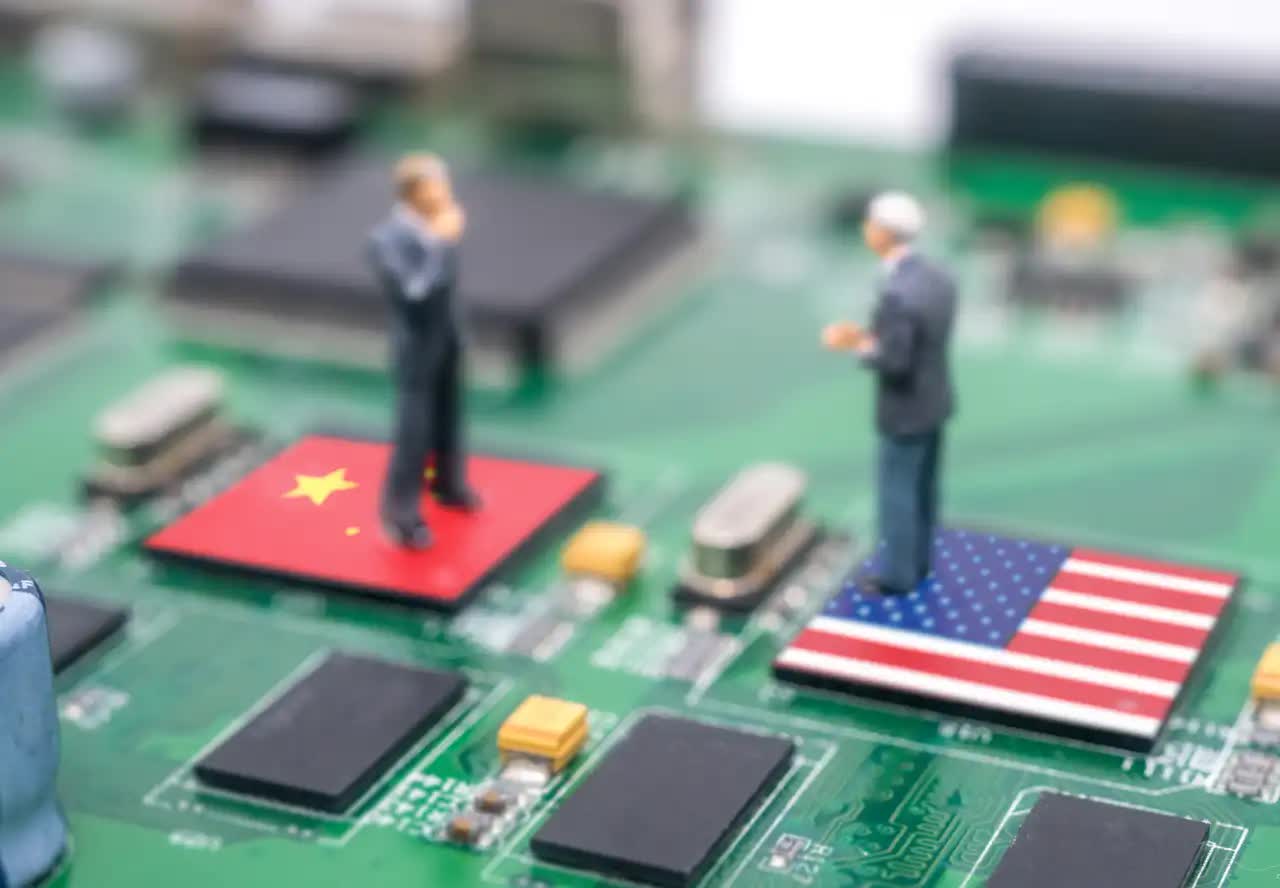

A sizzling potato: Like a prepare leaving the station, it now appears inevitable that US firms are shifting to scale back, or fully remove, their reliance on China. It took a very long time to get began, firms had been complaining about altering situations in China for a decade. The 2018 commerce struggle was the spark that basically obtained them shifting, and their progress has solely been gaining momentum since then. This course of will take years, perhaps a long time, however at this level might be unstoppable.

We just lately heard about Texas Instruments opening a packaging plant in Chengdu, and we mused that that is most likely the final semis plant TI, or any US firm, is ever going to open in China. But what’s going to decoupling entail for semis? There are two sides to this – China as a provider and China as a buyer.

Editor’s Note:

Guest writer Jonathan Goldberg is the founding father of D2D Advisory, a multi-functional consulting agency. Jonathan has developed progress methods and alliances for firms within the cell, networking, gaming, and software program industries.

As a buyer, China is a crucial market, however not as vital for different merchandise like luxurious items. In 2021, China imported about $433 billion of semis, which is a large slice of the business, however crucially, the massive majority of these imports had been packaged into different items after which exported to the remainder of the world as PCs and telephones and TVs.

In phrases of home consumption, China’s demand for semis and for merchandise containing semis is someplace nearer to 10%-15% of the business. This continues to be an enormous quantity, however a big portion of that’s beneath risk from home options, particularly round trailing edge processes, so it’ll fall it doesn’t matter what US firms do in China.

Barring severe geo-political strife, we predict it’s unlikely that US semis firms shall be fully blocked from China, so we have a tendency to think about this as much less dropping a buyer and extra of a protracted interval of gross sales headwinds. Less progress, not essentially declines.

The provider aspect is extra sophisticated. Today, China actually presents US semis firms two issues: trailing edge fabs and Outsourced Test and Assembly (OSAT, or packaging and testing).

Trailing edge fabs are considerably constrained now, however typically the world has ample capability to choose up a lot of the slack. Every manufacturing financial system is at present wanting so as to add trailing edge semis capability at the moment. Much of that won’t find yourself getting constructed, however sufficient of it is going to that we predict US firms could have many choices to select from. True, there are particular corners of the business which might be extra depending on China, reminiscence as an illustration, however for everybody else decoupling needs to be simpler.

OSAT is extra problematic. China’s packaging and testing capability has grown considerably over the previous decade. This is high-skilled, labor-intensive work that matches properly with China’s total manufacturing strengths. It will take appreciable work to scale back reliance on this. Other nations have some packaging capability, notably Malaysia, however China’s place right here is pretty robust.

On the opposite hand, packaging is changing into a extra vital a part of the semis ecosystem, it’s one a part of the answer to the slowing of Moore’s Law. As a end result, it has attracted appreciable consideration currently. The main foundries, like TSMC and Intel (not precisely a foundry but), have been investing closely of their packaging flows. Moreover, the standard OSAT circulate is already pretty distributed. We frequently work with semis firms who contract OSAT work to a single vendor, however that vendor will ship elements round Asia to stability capability and capabilities.

Extending this a bit additional, we predict additionally it is vital to have a look at China’s broader manufacturing functionality. This is prone to show the toughest a part of the availability chain to scale back reliance on China.

In elements of China, ISO certifications are so ingrained to the native tradition that we have now seen bars, eating places and related leisure venues proudly proclaim their adherence to certifiable course of experience.

China now has 40 years of compounding enhancements in its manufacturing expertise. Whole areas of the nation have webs of inter-connected manufacturing services from a whole bunch of special-purpose distributors to coaching faculties. In elements of China, ISO certifications are so ingrained to the native tradition that we have now seen bars, eating places and related leisure venues proudly proclaim their adherence to certifiable course of experience. Getting issues manufactured in China is simply simpler (not straightforward, however positively simpler). Ask anybody who has tried to develop a low-volume digital gadget lately – discovering dependable distributors within the US for design, sourcing, meeting and QA will be painful, whereas in China there are a whole bunch of companies that may do all of that in-house, normally for lots much less.

All of that is to say that decoupling semis, and electronics manufacture, from China needn’t be a traumatic course of, however it is going to take a few years. We have heard rumors that Apple is planning to thoroughly relocate the vast majority of its manufacturing outdoors China over the following seven years. And that’s Apple, most likely the world’s greatest at electronics provide chain administration. For everybody else, decoupling will come, however not shortly.

Carrot, stick and waiver

An vital query hovering across the US semis sanctions on China is will the US get its allies to assist the measures. People within the US could also be shocked to study that not all folks in the remainder of the world really feel the identical means about China, and much more surprising, these folks could have robust pursuits in persevering with to do enterprise with China.

We will not be coverage specialists (by a big margin), however we do have some sense of which firms in different nations will take essentially the most umbrage with the restrictions and a few issues which may be capable of offset these allies’ issues.

When the US issued the newest guidelines in October, the authors intentionally truncated the window between announcement and implementation, in some circumstances all the way down to solely every week. Past measures had normally been shared months prematurely of announcement. With these newest, far wider measures, the US authorities needed to remove the potential for last-minute hoarding orders. We additionally suspect they needed to restrict the power of US-based lobbyists to dilute the sanctions. Tactically, this made sense, but it surely got here at the price of the principles getting no outdoors vetting. US firms had little alternative to arrange, a subject for a future submit, however crucially the US authorities supplied primarily no discover to allies. To put it mildly, this was not acquired effectively.

There are 4 nations particularly most affected by these measures. The Netherlands – dwelling of ASML; South Korea – dwelling of Samsung, Hynix and a number of smaller distributors; Taiwan dwelling of TSMC, UMC and an enormous a part of the availability chain; and Japan – with a big electronics and WFE business. Add within the UK – dwelling of Arm, Germany whose industrial financial system is pretty reliant on China, and some of their neighbors results in issues with the EU extra broadly.

The scenario for every nation and set of firms is a bit totally different, however all of them discover themselves ready the place assist of their ally the US may instantly result in a lack of income, important quantities in lots of circumstances.

These firms symbolize some essential elements of the availability chain, and having the allies’ assist will possible imply the distinction between the success or failure of the measures. So how can the US hold its allies on-side? We assume there are 4 avenues to think about.

The first is a recognition of shared objectives. Many of those nations have proven rising concern over China’s conduct lately, and lots of the firms on this checklist suffered from the identical unfair commerce practices which sparked the commerce struggle within the first place. On the diplomatic entrance, China’s aggressive, “Wolf Warrior” diplomacy lately appears to have lower off extra diplomatic approaches to discovering widespread floor. We suspect that many of those nations share no less than a few of the US’ nationwide safety issues and financial nervousness round China, and so could assist the measures.

Even if that is true for governments, lots of the firms concerned could search to influence their governments to permit them to proceed doing enterprise with China. Some of the businesses have already invested closely in China and dropping entry to these property poses pretty severe hardship.

In significantly acute circumstances, the US authorities has been providing waivers to the principles.

In significantly acute circumstances, the US authorities has been providing waivers to the principles. Hynix and Samsung appear to have gotten these, and from what we will inform the US is being pretty lenient in handing these out for ally nations. However, the waivers are good for just one 12 months, and nobody actually is aware of if these shall be prolonged. From what we will inform, the US appears to be adopting selective enforcement of some its insurance policies, which isn’t actually a consolation to most firms, however does point out some extent of flexibility.

On the opposite aspect of the ledger, the US authorities has made it clear repeatedly that it has a proverbial “stick” to burnish to “encourage” compliance. The new (and previous) guidelines make it fairly clear that any product that include any mental property which may in anyway be tied to the US makes the entire product topic to the rules. This is most obvious within the case of ASML, who has a big software program operation within the US.

ASML’s EUV machines are very a lot on the coronary heart of the sanctions, and we predict the US authorities will go a reasonably good distance to make sure that none of these get bought to China. To a lesser diploma this holds true for TSMC as effectively. In addition to their dependence on equipment with US IP in it, there may be additionally the matter of EDA instruments, a vital a part of the foundry course of circulate. The EDA firms are all US-based, and their removing from the equation gums up the entire business.

In between these two extremes the US appears to be contemplating an entire host of measures to assuage international issues over the sanctions. In the Digits to Dollars e-newsletter, we linked to a Digitimes report that cautioned the US is contemplating curbs on China’s OLED TV makers.

China’s TV makers are an enormous a part of the business, however it’s laborious to see them as threatening to the US. They function in a super-competitive market, eking out meager income. The US has no home distributors and would appear to have little cause to go after this sector. That being mentioned, South Korea, Japan and Taiwan all care lots about TVs and have needed to take care of years of low-cost PRC competitors consuming into their market share.

We don’t know if the US is definitely going to take any actions in opposition to China’s TV makers, however it might most likely be a wise diplomatic transfer to supply these as much as its allies. (Pro-tip for US regulators: check out these firms’ knowledge assortment and retention agreements.)

Moving past semis, we additionally assume there are different incentives that these sanctions may present to allied nations’ firms. From our viewpoint, probably the most contentious elements of the sanctions shall be what they imply for China’s nascent automotive business. China has ~50 EV makers at the moment, and the PRC would very very similar to to have a globally aggressive auto business. As we have now famous, semis are an more and more vital a part of the business. China is on a path to self-sufficiency for analog and trailing edge auto semis, however the way forward for the auto business will rely closely on entry to forefront digital processors for ADAS and autonomy methods. If China’s auto makers are unable to acquire these chips they are going to be at a major aggressive drawback. This is a scenario which different nations would possibly admire. Germany, as an illustration. We think about there are various different related factors of leverage which the US can apply, if crucial.

Putting this all collectively, we predict the US has sufficient arrows in its quiver to generate assist from allies. It isn’t clear if the US authorities will be capable of win over assist from a few of the particular person firms, however we suspect their governments will see causes to come back round.