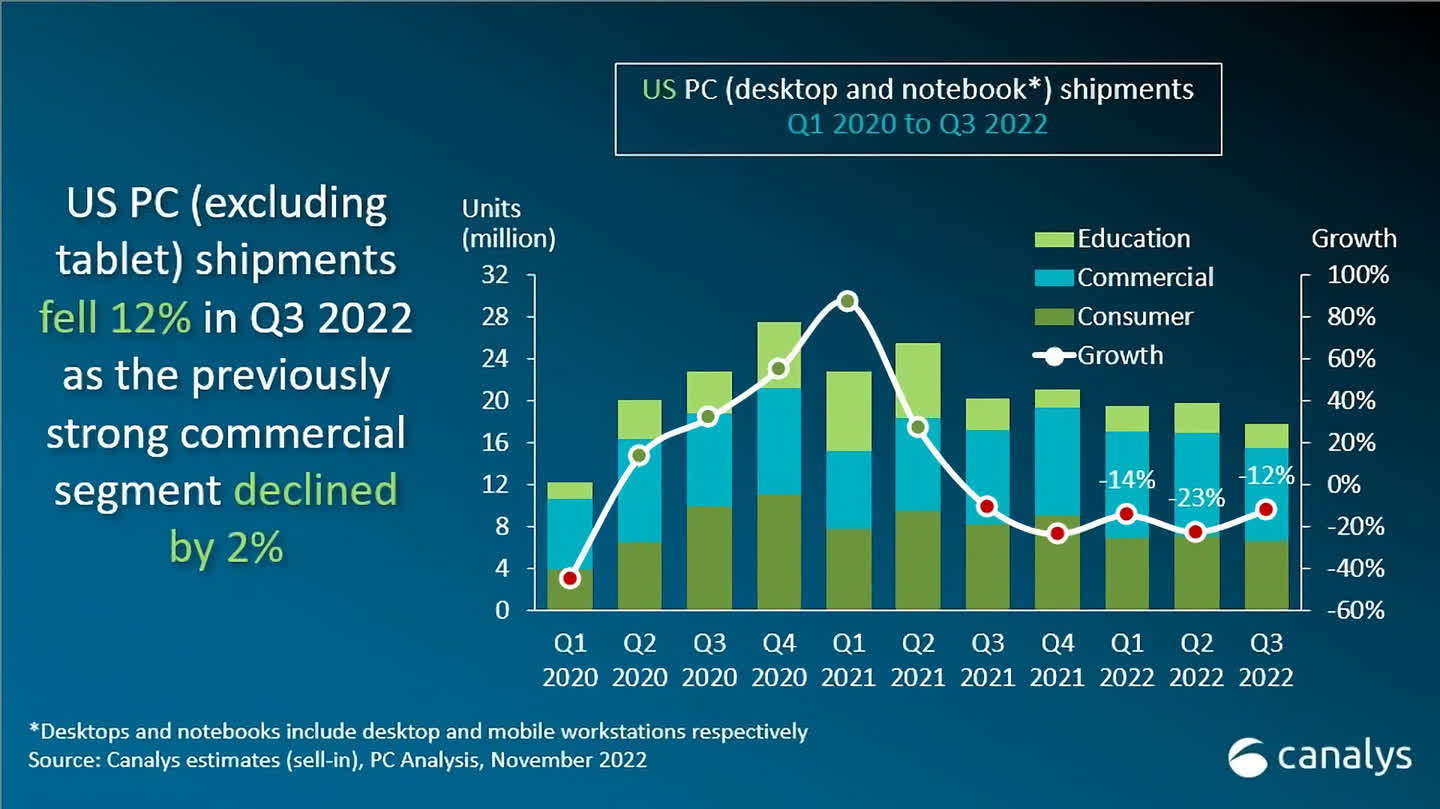

The massive image: Domestic deliveries of desktops, notebooks and workstations collectively dipped 12 p.c inside the 3rd one-fourth of 2022, from 20.3 million models in Q3 2021 to 17.8 million designs within the newest interval that is three-month. Among them, notebooks suffered the largest decline at 14 p.c and desktops grew a modest one p.c based on the most recent report from market analysis agency Canalys.

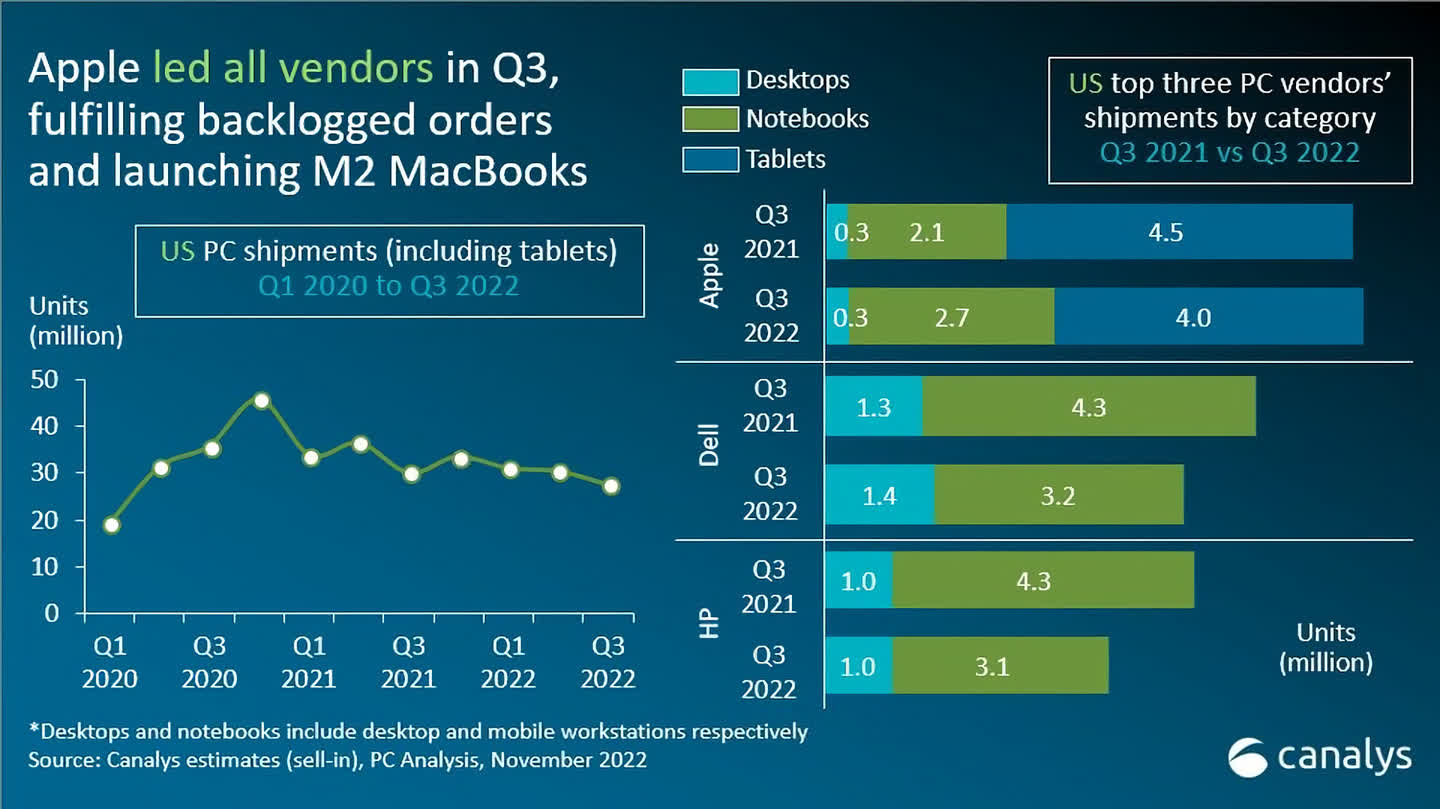

Dell led the way in which within the quarter that is third 4.7 million practices sent inside the United States followed by HP at 4.1 million and Apple at three million. Among the greatest 5 suppliers by volume, exclusively Apple and Acer talented useful progress that is annual. HP noticed gross sales slide greater than 23 p.c yr over yr and Lenovo’s US shipments had been down 22.2 p.c.

Factoring tablets into the equation places Apple in first place by a margin that is large. Cupertino shipped 4 million iPads in Q3, followed by Amazon in 2nd destination with 2.7 million Fire pills sent. Third destination visited Samsung with 1.6 million designs sent through the interval that is identical

Among the highest 5 pill producers, solely Amazon and TCL posted progress that is annual. Apple, Samsung and Microsoft all reported double-digit quarterly dips when comparing to the interval that is identical 2021.

Despite the dips, producers and retailers are doing all the pieces they will to spur gross sales together with ramping up promotions in the course of the holidays. We noticed a number of enticing offers on supply throughout Black Friday and Cyber Monday week they usually’re more likely to hold coming proper till the minute that is final. Then most likely, you have post-holiday revenue due to everyone will require the one thing to spend their particular incentive handmade cards and money that is newfound.

Canalys analysis analyst Brian Lynch expects the PC that is US to handle extra headwinds aside from the This autumn getaway period. Cash-strapped buyers tend to be expected to go to cut paying for expensive expertise product, causing retail stocks increasing faster than revenue. The education industry is forecast to begin a restoration that is sluggish year but the most of system refreshes are actually expected to take place in 2024.

Image credit rating: Santeri Viinamäki