[ad_1]

In transient: The chip growth of the previous two years that spurred a world scarcity is coming to an finish, and that should not shock anybody. Chipmakers, shopper tech corporations, and retailers predict rockier months forward, however customers can lastly hope for good availability and pricing on each current-gen and next-gen merchandise.

This yr, the smartphone market skilled one in every of its worst first quarters of the previous a number of years. Global shipments fell greater than 11 p.c in comparison with 2021, and the European market noticed its most important decline in a decade.

Some of that decline was anticipated as a result of seasonality, so cellphone makers like Samsung began lowering their manufacturing accordingly. That mentioned, market analysts at Counterpoint estimate that cell chipset revenues grew round 23 p.c within the first three months of 2022 because of a shift in shopper demand towards costlier 5G handsets.

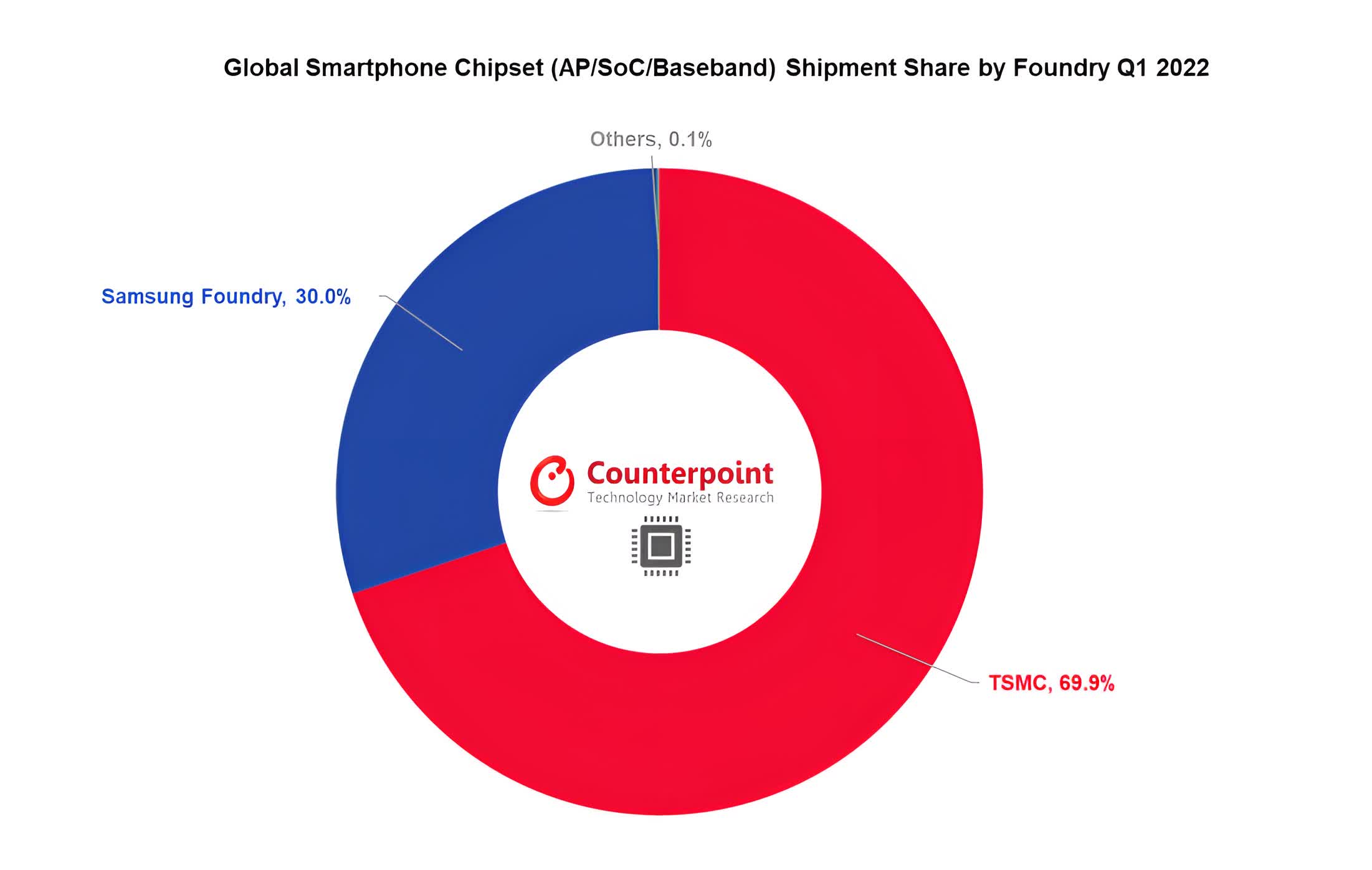

TSMC took the lion’s share of contract manufacturing for these chipsets — an estimated 70 p.c of SoCs and mobile modems had been made utilizing the Taiwanese firm’s newest course of nodes (7nm, 6nm, 5nm, and 4nm). Samsung took many of the remaining chip orders and is at present seeking to woo extra clients with its cutting-edge 3nm course of node, which is the primary to make use of gate-all-around field-effect transistors.

When zooming in on TSMC, analysts discovered that chipset gross sales had declined 9 p.c year-over-year for the three months ending in March. That state of affairs is predicted to vary within the coming months as Qualcomm will shift extra of its chip orders to TSMC as an alternative of Samsung. Notably, this choice was made after the Korean large skilled yield issues on its 4nm course of node.

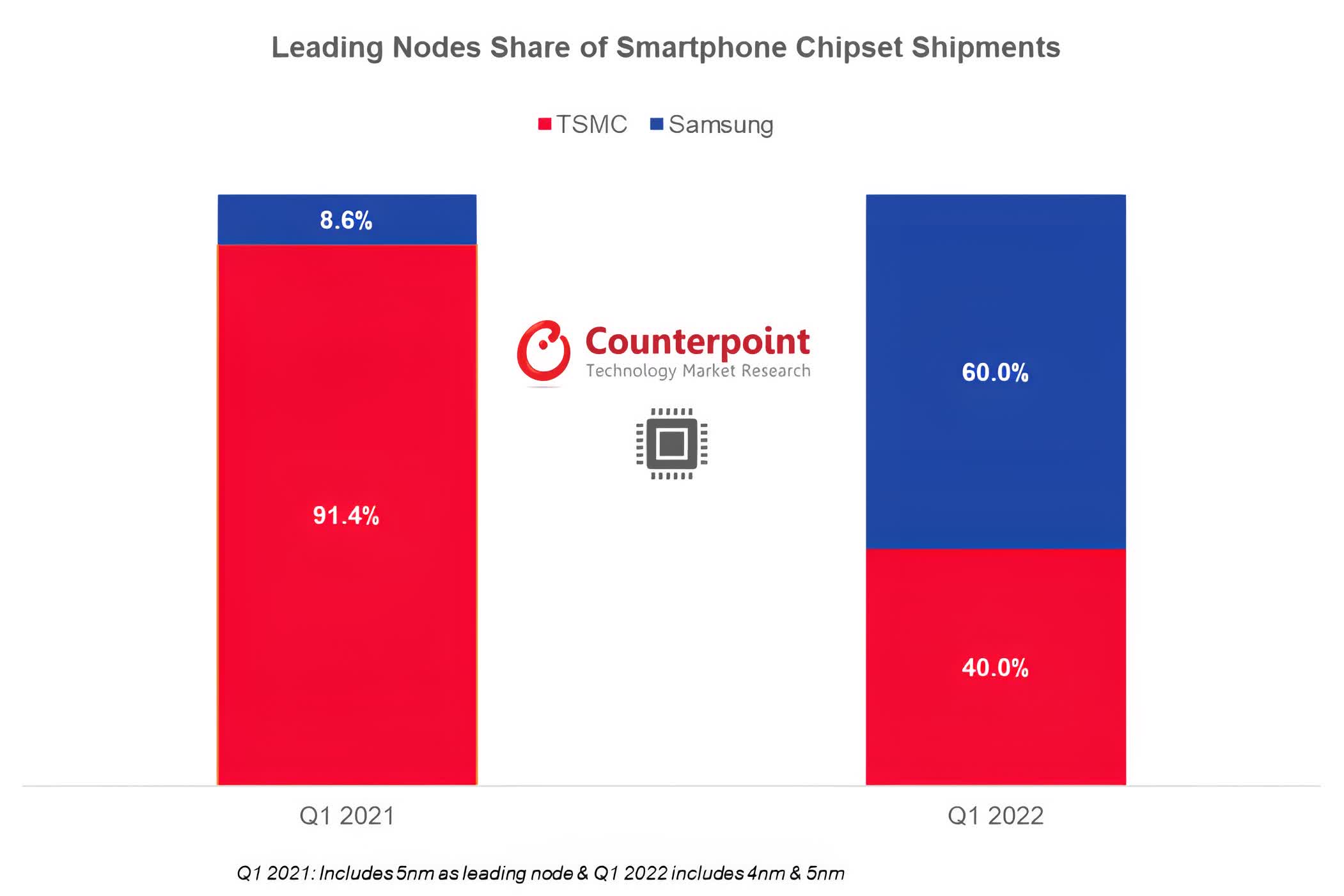

Despite these points, Samsung holds a robust place with regards to 5nm and 4nm nodes. The firm went from transport lower than 9 p.c of all superior cell chips in Q1 2021 to a minimum of 60 p.c within the first quarter of this yr.

Overall, shopper demand for smartphones is predicted to drop within the coming months as a result of inflation and rising fears of an imminent international recession. That mentioned, there are indicators the tech provide chain might lastly be therapeutic after struggling a number of shocks over the previous two years.

A PatternForce report suggests the chip scarcity as we all know it might be coming to an finish earlier than beforehand anticipated. Foundries have seen a wave of order cancellations that can lead to capability being underutilized in direction of the tip of this yr.

| Wafer Size | Process node | Target merchandise | H2 2022 Capacity Utilization |

|---|---|---|---|

| 200mm | 0.35 — 0.11μm | Display Driver ICs, PMICs, Contact Image Sensors | 90-95% |

| 300mm | 90/55nm | Microcontrollers, PMICs, TDDI, Wi-Fi | 90-99% |

|

300mm |

40/28nm | AMOLED Display Driver ICs, Wi-Fi, 4G modems, TV SoCs, Platform Controller Hubs | 90-99% |

| 300mm | 1Xnm | 4G/5G modems, FPGAs, ASICs, Wi-Fi, TV SoCs, Platform Controller Hubs | 95-100% |

| 300mm | 7nm — 4nm | CPUs, GPUs, ASICs, cell SoCs, FPGAs, AI Accelerators | 95-100% |

The first of those revisions is for 200mm and 300mm wafers made utilizing mature course of nodes like 12 nm and past. This implies that producers now not have issues sourcing PMICs, microcontrollers, show driver ICs, and different much-needed elements. Analysts imagine some foundries may have issues sustaining manufacturing capability at 90 p.c, particularly as producers are beginning to take care of a buildup in stock.

More superior chip fabrication traces should still see anyplace between 95 p.c to full utilization charges. That means corporations that design CPUs, GPUs, ASICs, 5G modems, and cell chipsets do not see any motive to make fewer of them simply but. At the identical time, foundries aren’t prepared to surrender orders and can, at greatest, provide delays in shipments of as much as three months.

For players who’re ready for brand spanking new CPUs and GPUs from Intel, Nvidia, and AMD, that is positively excellent news because it means availability will not be a significant situation. Add to {that a} flood of used GPUs on the second-hand market and waning demand for PC motherboards, and now we have the suitable situations for extra inexpensive system upgrades.

[ad_2]