The Financial Times just lately printed an in-depth report on how Apple constructed its provide chain in China. It’s an in-depth have a look at an vital concern, and its creator, Patrick McGee, reveals some startling particulars. Since we supplied some shade quotes on the finish, we have been requested loads recently how lengthy it would take to untangle this provide chain — each for China and for the U.S. tech trade. The quick reply is – a very long time.

The drawback with this sort of evaluation is that there isn’t any simple method to quantify the issue. We may have a look at world manufacturing output, the place China has a 28.7% share and the US has a 16.8% share, or simply shopper electronics, the place the share is extra uneven. But that is solely a part of the image.

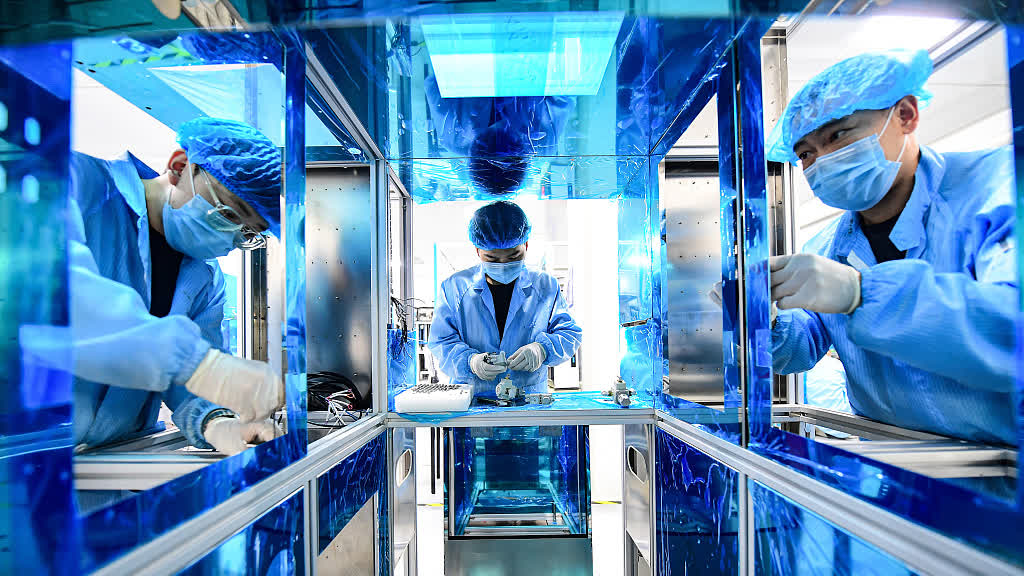

South China’s electronics complicated is constructed on human capital and intangible property in addition to plain, old school capital and cash. This makes it more durable for others to duplicate.

Many of China’s present capabilities transcend mere export. One of essentially the most fascinating elements of the South China electronics complicated is how entrenched it’s all through the economic system. The Financial Times gave an unbelievable statistic. They appeared on the ISO certification. ISO is a global requirements physique that certifies firms in accordance with an in depth set of course of {qualifications} and finds that:

China’s dominance will be quantified partially. In 2021, the variety of organizations audited within the nation to substantiate greatest practices in “high quality administration programs” (ISO 9001 certification) was 426,716, accounting for about 42% of the worldwide complete. For India, the determine is 36,505; for the US, 25,561.

Financial Times: How China is linking wealth to China

In elements of southern China, ISO has grow to be such a characteristic of main employers that many of those practices have been adopted by native service firms, and eating places and nightclubs are additionally searching for ISO certification, presumably on the belief that their patrons recognize high quality.

This actually will get to the center of the matter, China’s manufacturing capabilities are measured by intangible property and human capital simply as they’re measured by laborious statistics and plain quaint bodily capital and cash.

Editor’s observe:

Guest creator Jonathan Goldberg is the founding father of D2D Advisory, a multi-purpose consulting agency. Jonathan develops progress methods and alliances for firms within the cell, net, gaming, and software program industries.

For an organization like Apple, meaning scale — the power to provide tons of of thousands and thousands of extremely dependable iPhones a 12 months. For smaller firms, this implies flexibility and fast turnaround. We just lately labored with an organization trying to supply from a US producer. Halfway by way of planning, they found they wanted a selected manufacturing instrument, however the contract producer had no expertise with that gear, so manufacturing was delayed by a number of months whereas they sought rental, and it was more durable to seek out. A staff that is aware of the right way to use it.

In Shenzhen, against this, there are a dozen firms specializing within the form of instrument they’ll ship to the manufacturing unit flooring tomorrow, and a crew to function it. Industrial clusters are a well known phenomenon, however when it comes to scale and depth, no cluster can examine with as we speak’s Shenzhen.

Having mentioned that, the practice has left the station. American firms are doing every part they’ll to scale back and/or remove their dependence on China. We’ve heard rumors that Apple needs to maneuver most of its manufacturing out of China inside 5 years. We do not know if that is true, however solely Apple may take into account such a timeline. There is not any ready-made different, and there in all probability by no means will likely be.

The electronics provide chain of the long run might be scattered throughout a dozen international locations, together with Mexico, Vietnam and Malaysia. This fragmentation will increase friction within the system and will make it extra weak to periodic outages.

Nor is China standing nonetheless. Labor prices in China have been rising for years, backed by rising incomes and unfavorable demographics. When Apple began manufacturing in China, most Foxconn staff have been seasonal, commuting to and from their rural hometowns in the course of the low season. Today, their factory-working youngsters usually tend to develop up not less than partially within the metropolis and wish iPhones and iPads themselves. While the latest commerce spat between the U.S. and China was the catalyst to begin the method, it’s nearly actually inevitable.

Image credit score: Robert Bye, CGTN