[ad_1]

The huge image: If the transaction does undergo, it will be one of many greatest tech offers ever, simply behind Microsoft’s pending acquisition of Activision Blizzard for $69 billion and Dell’s EMC buyout for $67 billion (a deal that included VMware).

Today, Broadcom introduced plans to purchase VMware in a cash-and-stock transaction valued at roughly $61 billion. The deal would additionally lead to Broadcom assuming VMware’s $8 billion in debt.

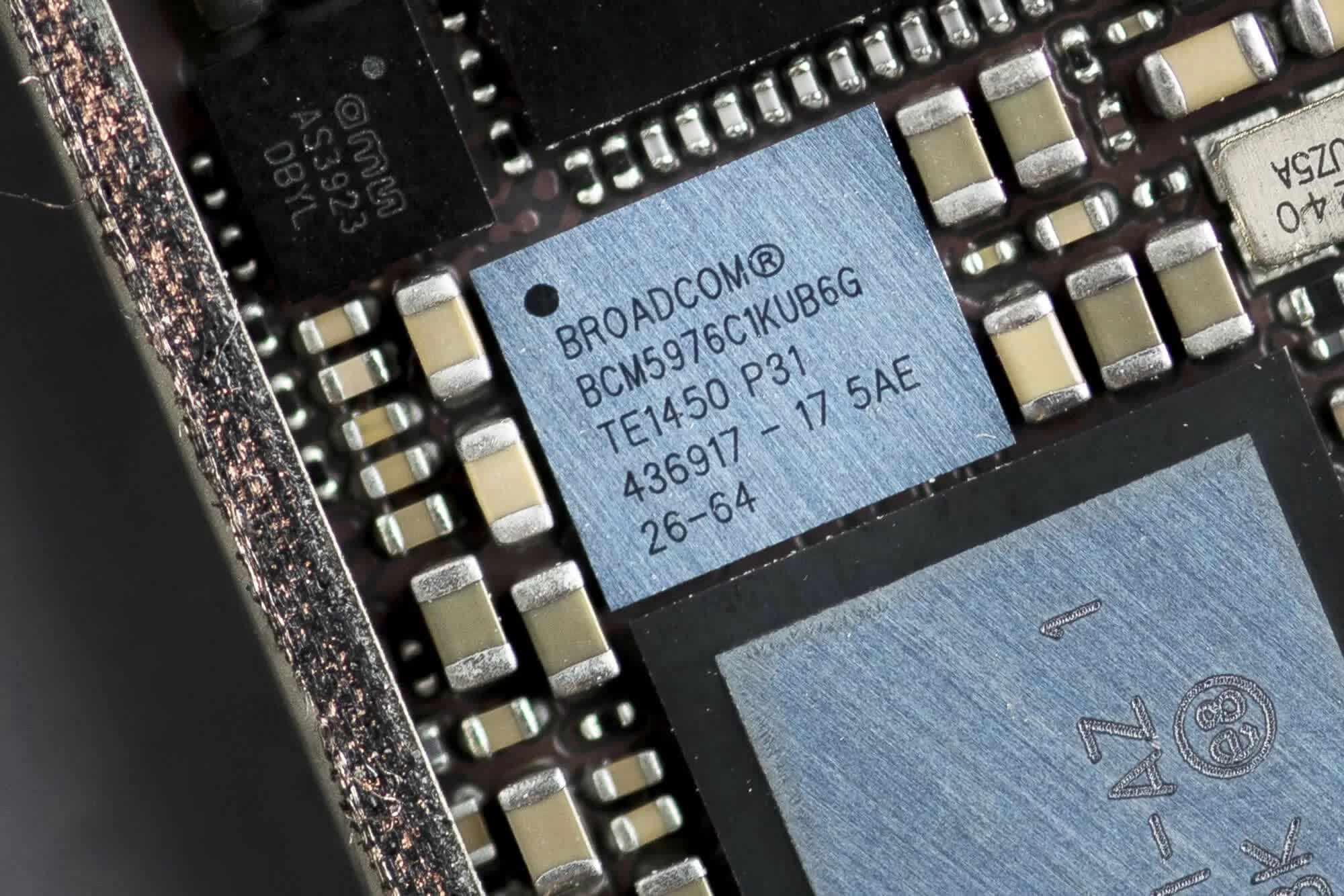

Broadcom is especially recognized for designing and manufacturing a variety of semiconductor merchandise, together with Wi-Fi, Bluetooth, and GPS chips utilized in many smartphones and routers.

VMware is a cloud computing and virtualization expertise firm. The agency launched in 1998 and was acquired by EMC in 2004. It turned a part of Dell when the latter purchased EMC in 2016 earlier than spinning off to grow to be a standalone firm once more final yr.

If the deal does undergo, Broadcom plans to rebrand its Broadcom Software Group to VMware and incorporate its present infrastructure and safety software program portfolio as a part of VMware.

Michael Dell, who personally owns greater than 40 p.c of excellent Dell inventory, and international personal fairness agency Silver Lake, which owns one other 10 p.c, have each given their approval to the deal.

The acquisition is predicted to shut in Broadcom’s fiscal yr 2023, which begins in November 2022.

It’s price mentioning that Broadcom additionally tried to accumulate fellow chipmaker Qualcomm a couple of years in the past for over $100 billion. That deal fell via when former president Donald Trump blocked the acquisition, citing nationwide safety issues.

[ad_2]