[ad_1]

In temporary: Asus has confirmed what many in PC trade had suspected: demand for graphics playing cards used for crypto mining is “disappearing.” That’s the excellent news. The unhealthy information is that demand for PCs can be shrinking, by about 10%, however subsequent 12 months will see gross sales of gaming laptops surge.

As per The Reg, Asus CEO S.Y. Hsu made the feedback throughout the firm’s Q1 earnings name. He famous that the falling demand for GPUs used for mining was primarily because of the crypto trade addressing criticism of the quantity of power mining consumes.

Hsu is probably going referring to Ethereum’s upcoming transfer from its present proof-of-work mannequin to proof-of-stake, which in idea will finish the requirement for high-end GPUs to mine the tokens. Ethereum developer Tim Beiko just lately confirmed that the earlier swap date of June is now not occurring, although he believes it can “probably” happen inside the next few months.

It will not be June, however probably within the few months after. No agency date but, however we’re positively within the last chapter of PoW on Ethereum

— Tim Beiko | timbeiko.eth “🧱 (@TimBeiko) April 12, 2022

Hsu additionally warned that PC gross sales would return to the pre-Covid days of slowing progress in Q2 and fall 10% Quarter-on-Quarter, partly due to the lockdowns in China. Component gross sales, in the meantime, have been predicted to fall between 10% and 15%. The CEO was extra optimistic about subsequent 12 months, although, predicting an increase in gaming laptop computer gross sales, which he stated younger folks view as an vital piece of dwelling leisure tech.

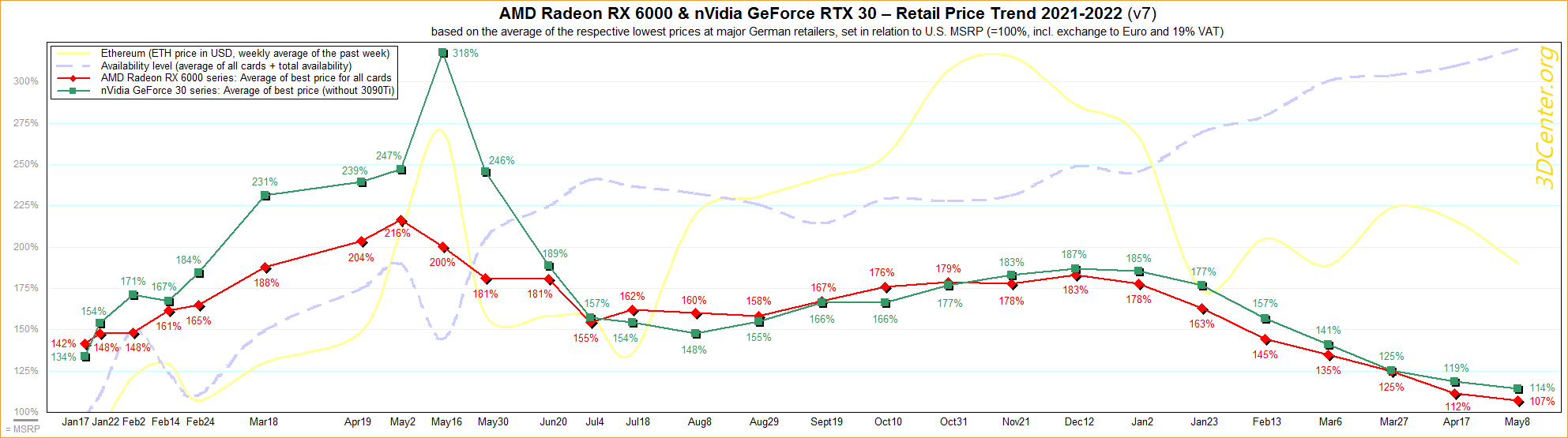

Another issue will doubtlessly be the crashing crypto market. Almost $1 trillion has been wiped from the cryptocurrency markets this week, and low crypto values imply much less mining profitability, which in flip will increase GPU availability and lowers costs. Graphics playing cards are already nearer to their MSRP than they’ve been for the reason that disaster began, and falling mining demand is pushing their costs down even additional.

Another attention-grabbing a part of Hsu’s speech associated to the worldwide element shortages which have been plaguing the trade for therefore lengthy. “When it involves built-in circuits, the availability is in a manageable stage,” he stated, with energy administration chips being the exception. Shortages of digital camera parts and printed circuit boards are proving to be a difficulty, although, as is US port congestion and shortages of containers and truck drivers.

“The present state of affairs just isn’t getting worse, however the constraints stay. Therefore, whether or not you’re looking at delivery charges or air freight, the fee stays excessive. Of course, excessive delivery prices is creating price strain for us. But nonetheless, it is all within the anticipated and manageable stage.”

Backing up Hsu’s remarks was this week’s report that shipments of desktop processors have seen their largest quarterly drop ever: 30%.

[ad_2]